Revenues reached $1.41 billion in the third quarter, rising 68% year over year. Adjusted EBITDA grew 79% to $1.16 billion, translating to an 82% margin. This reflected exceptional operational efficiency and scalability. Free cash flow soared 92% year over year to $1.05 billion, emphasizing the company’s ability to generate substantial cash from its operations.

At the core of this dynamic is the MAX–AXON flywheel. Growth in MAX supply expands impressions and behavioral data, which strengthens AXON’s performance models. Better outcomes attract more advertiser spend, which further deepens the data advantage. Importantly, the early traction from the self-service AXON Ads Manager reinforces this loop without introducing heavy sales or marketing costs.

If this operating leverage persists, AppLovin is transitioning from a high-growth ad-tech firm into a structurally cash-generative platform. That shift explains why the market continues to reassess the durability of its margins and long-term earnings power.

Peer Context: How Others Compare

Unity Software U remains deeply tied to mobile gaming monetization, but continues to struggle with margin stability. While Unity Software benefits from a strong developer reach, its revenue does not yet exhibit the same bottom-line efficiency that AppLovin is achieving.

The Trade Desk TTD operates a best-in-class demand-side platform and has proven scalable economics over time. However, The Trade Desk’s margins still reflect higher reinvestment needs compared to AppLovin’s current flow-through profile, making the contrast increasingly clear.

APP’s Price Performance, Valuation and Estimates

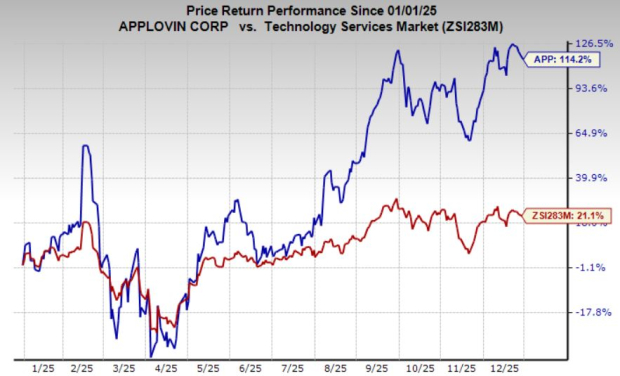

The stock has gained 114% over the past year compared with the industry’s 21% growth.

Image Source: Zacks Investment Research

From a valuation standpoint, APP trades at a forward price-to-earnings ratio of 45.82X, which is well above the industry average of 26.06X. It carries a Value Score of D.

The Zacks Consensus Estimate for the company’s earnings has been on the rise over the past 60 days.

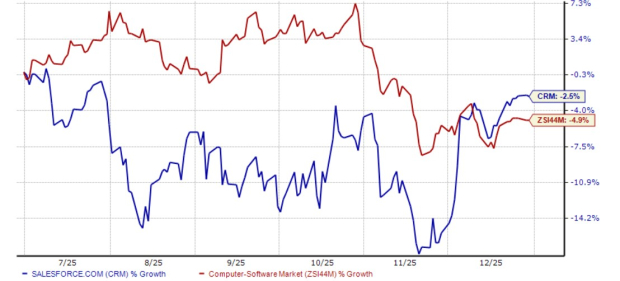

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

APP currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Zacks Naming Top 10 Stocks for 2026

Want to be tipped off early to our 10 top picks for the entirety of 2026? History suggests their performance could be sensational.

From 2012 (when our Director of Research Sheraz Mian assumed responsibility for the portfolio) through November, 2025, the Zacks Top 10 Stocks gained +2,530.8%, more than QUADRUPLING the S&P 500’s +570.3%.

Now Sheraz is combing through 4,400 companies to handpick the best 10 tickers to buy and hold in 2026. Don’t miss your chance to get in on these stocks when they’re released on January 5.

Be First to New Top 10 Stocks >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

AppLovin Corporation (APP): Free Stock Analysis Report

The Trade Desk (TTD): Free Stock Analysis Report

Unity Software Inc. (U): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).